In the world of retail credit cards, consumers are often faced with a myriad of options, each promising unique benefits and rewards. One such contender in this competitive market is the eBay Mastercard. But how does it stack up against other retail credit cards? In this comprehensive analysis, we’ll explore the eBay Mastercard in detail, compare it with other popular retail credit cards, and help you determine which one is right for you.

Understanding the eBay Mastercard

The eBay Mastercard is a co-branded credit card offered by eBay in partnership with Synchrony Bank. Designed to enhance the shopping experience on eBay, this card provides a range of benefits tailored to frequent eBay users. Here are some of the key features and benefits of the eBay Mastercard:

Key Features of the eBay Mastercard

- Rewards Program: The eBay Mastercard offers a competitive rewards program, allowing cardholders to earn points on their purchases. Specifically, users can earn:

- 5 points per dollar spent on eBay when they have an eBay account in good standing and are enrolled in the eBay Extras Rewards program.

- 2 points per dollar spent on gas, restaurant, and grocery store purchases.

- 1 point per dollar spent on all other purchases.

- Sign-Up Bonus: New cardholders can often take advantage of a sign-up bonus. For instance, a typical offer might include earning 5,000 bonus points after spending $1,000 within the first 90 days of account opening.

- No Annual Fee: The eBay Mastercard comes with no annual fee, making it an attractive option for those who want to maximize their rewards without incurring extra costs.

- Fraud Protection: Cardholders benefit from zero liability fraud protection, which ensures that they are not held responsible for unauthorized charges.

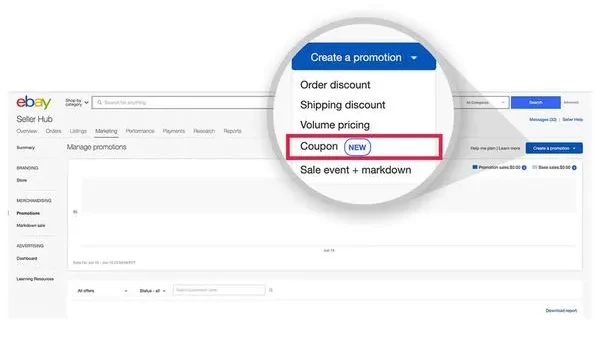

- Exclusive Offers: Periodically, eBay Mastercard holders receive exclusive offers and discounts on eBay, adding further value to the card.

Comparing the eBay Mastercard with Other Retail Credit Cards

While the eBay Mastercard offers compelling benefits for avid eBay shoppers, it’s essential to compare it with other retail credit cards to determine which one aligns best with your spending habits and financial goals. Let’s take a look at some popular retail credit cards and see how they measure up against the eBay Mastercard.

Amazon Prime Rewards Visa Signature Card

The Amazon Prime Rewards Visa Signature Card is a strong competitor in the retail credit card space, especially for those who frequently shop on Amazon.

Key Features

- Rewards Program:

- 5% back on Amazon.com and Whole Foods Market purchases for Prime members.

- 2% back at restaurants, gas stations, and drugstores.

- 1% back on all other purchases.

- Sign-Up Bonus: A $100 Amazon gift card is instantly awarded upon approval.

- Annual Fee: While the card itself has no annual fee, it requires an Amazon Prime membership, which costs $139 per year.

- Additional Benefits: No foreign transaction fees, travel accident insurance, and access to Visa Signature benefits.

Comparison with eBay Mastercard

The Amazon Prime Rewards Visa Signature Card offers a more robust rewards program for Amazon and Whole Foods shoppers, with a higher cash back rate on these purchases. However, it does require an Amazon Prime membership, which adds to the overall cost. In contrast, the eBay Mastercard does not have any associated membership fees and offers competitive rewards for eBay purchases.

Target REDcard

The Target REDcard is another popular retail credit card, known for its straightforward discount structure.

Key Features

- Rewards Program: 5% off on all Target purchases, both in-store and online.

- Sign-Up Bonus: Often includes a discount on the first purchase made with the card.

- Annual Fee: No annual fee.

- Additional Benefits: Free two-day shipping on select items at Target.com and extended returns.

Comparison with eBay Mastercard

The Target REDcard offers a simple and attractive 5% discount on all Target purchases, making it a strong choice for frequent Target shoppers. However, it doesn’t provide rewards for purchases made outside of Target. The eBay Mastercard, on the other hand, offers more versatile rewards that can be earned on a broader range of purchases, including gas, groceries, and dining.

Walmart Rewards Card

The Walmart Rewards Card is designed for Walmart shoppers, offering rewards on purchases made at Walmart and affiliated stores.

Key Features

- Rewards Program:

- 5% back on Walmart.com purchases, including grocery pickup and delivery.

- 2% back on Walmart in-store purchases, at restaurants, and on travel.

- 1% back on all other purchases.

- Sign-Up Bonus: Earn 5% back on in-store purchases when using Walmart Pay for the first 12 months after approval.

- Annual Fee: No annual fee.

- Additional Benefits: Fraud protection and no foreign transaction fees.

Comparison with eBay Mastercard

The Walmart Rewards Card provides higher rewards for Walmart.com purchases, making it ideal for Walmart enthusiasts. However, the eBay Mastercard offers higher rewards on eBay purchases and a more balanced reward structure for other categories like gas and dining. Your choice between these cards would depend on your primary shopping destination and where you spend the most.

Best Buy Credit Card

The Best Buy Credit Card is tailored for tech enthusiasts and those who frequently shop at Best Buy.

Key Features

- Rewards Program:

- 5% back in rewards on Best Buy purchases (6% for Elite Plus members).

- Limited-time offers for additional rewards on select categories.

- Sign-Up Bonus: Often includes a promotional financing offer on large purchases.

- Annual Fee: No annual fee for the standard version, but the Best Buy Visa Gold version carries a fee.

- Additional Benefits: Flexible financing options and access to exclusive sales events.

Comparison with eBay Mastercard

The Best Buy Credit Card is a great option for those who frequently purchase electronics and other items from Best Buy, offering high rewards and financing options. However, its rewards are primarily limited to Best Buy purchases. The eBay Mastercard provides a more flexible rewards program that encompasses a wider range of spending categories, making it more versatile for general use.

Factors to Consider When Choosing a Retail Credit Card

Choosing the right retail credit card involves considering several factors beyond just the rewards program. Here are some critical aspects to evaluate:

Spending Habits

Your spending habits play a crucial role in determining the best retail credit card for you. Consider where you spend the most money and which rewards categories align with your expenses. If you primarily shop on eBay, the eBay Mastercard would be a clear choice. However, if you frequently shop at multiple retailers, you might benefit from a card with broader rewards categories.

Sign-Up Bonuses

Sign-up bonuses can provide a significant boost to your rewards earnings. Compare the sign-up bonuses offered by different cards and assess how easy it is to meet the spending requirements. The eBay Mastercard typically offers a substantial bonus for new cardholders, making it an attractive option if you’re planning a large purchase soon.

Annual Fees

While many retail credit cards come with no annual fee, some, like the Amazon Prime Rewards Visa Signature Card, require a membership fee. Calculate the overall cost of the card, including any membership fees, and weigh it against the potential rewards you’ll earn.

Additional Benefits

Beyond rewards, consider the additional benefits that come with each card. These can include fraud protection, extended warranties, exclusive discounts, and travel insurance. For instance, the eBay Mastercard offers zero liability fraud protection, providing peace of mind for your online purchases.

Flexibility and Redemption Options

Evaluate the flexibility and ease of redeeming your rewards. Some cards offer straightforward cash back, while others provide points that can be redeemed for travel, gift cards, or merchandise. The eBay Mastercard allows you to redeem points for eBay purchases, gift cards, and statement credits, offering multiple options to maximize your rewards.

Making the Final Decision

Ultimately, the best retail credit card for you depends on your personal preferences and financial goals. Here are some scenarios to help you decide:

- Frequent eBay Shopper: If you frequently shop on eBay and want to maximize your rewards on eBay purchases, the eBay Mastercard is an excellent choice. Its 5x points on eBay purchases and no annual fee make it highly attractive for eBay enthusiasts.

- Amazon Loyalist: If you’re an Amazon Prime member and do most of your shopping on Amazon, the Amazon Prime Rewards Visa Signature Card offers unmatched rewards and benefits for Amazon purchases.

- Target Shopper: For those who regularly shop at Target, the Target REDcard provides a straightforward 5% discount on all Target purchases, both in-store and online.

- Walmart Customer: If Walmart is your go-to retailer, the Walmart Rewards Card offers substantial rewards on Walmart.com purchases and competitive rewards on in-store purchases.

- Tech Enthusiast: If you frequently buy electronics from Best Buy, the Best Buy Credit Card provides significant rewards and financing options for your purchases.

In conclusion, the eBay Mastercard stands out for its generous rewards on eBay purchases and versatile earning categories. However, it’s essential to compare it with other retail credit cards based on your spending habits, the specific benefits each card offers, and how well they align with your financial objectives. By carefully evaluating these factors, you can make an informed decision and choose the retail credit card that best suits your needs.